Qualified Metal Roof Credit

The first part of this credit was worth 10 of the cost of qualified energy saving equipment or items added to a taxpayer s main home in the past year.

Qualified metal roof credit. Metal roofs with pigmented coatings and asphalt roofs with cooling granules. Does any guidance issued for the energy credit under section 48 of the internal revenue code apply to the residential energy efficient property tax credit under section 25d of the internal revenue code. There is a total combined credit limit of 500 for all purchases improvements for all years since 2005. This tax credit is for energy star certified metal and asphalt roofs with pigmented coatings or cooling granules designed to reduce heat gain.

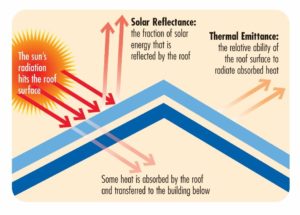

A roofing tax credit is a credit given to homeowners who install a new more energy efficient roof on their home. Asphalt and metal roofs if your roof meets energy star standards your roof will reflect more of the sun and reduce surface temperatures by up to 100 f. Is there a tax credit for replacing your roof. For example energy efficient exterior windows and doors certain roofs and added insulation all qualify but costs associated with the installation weren t included.

Learn more and find products. This credit is worth 10 of the cost and a maximum of 200 and 500 for windows skylights and doors respectively. Including qualified insulation windows doors and roof. 10 of cost note.

Homeowners may qualify for a federal tax credit for installing certainteed energy star qualified roofing products. Any metal roof with appropriate pigmented coatings or asphalt roof with appropriate cooling granules that are specifically and primarily designed to reduce the heat gain of your home. With the federal property tax credit incentive having been retroactively extended until december 31 2020 homeowners who made an energy efficiency home improvement by installing an asc building products energy star qualified metal roof as early as 2018 should know the following. The united states has instituted a federal roofing tax credit which encourages homeowners to re roof with energy star products.

The tax credit program was aimed to create jobs in the. Components such as a roof s decking or rafters that serve only a roofing or structural function do not qualify for the credit. This tax credit amounts to 10 of the total cost. You may qualify for a tax credit of up to 500 if your roof meets certain energy requirements.

Tax credits for replacing your roof. If you are replacing or adding on to your existing roof you may qualify for an energy efficient home improvement tax credit through energy star.